About Axy Validator

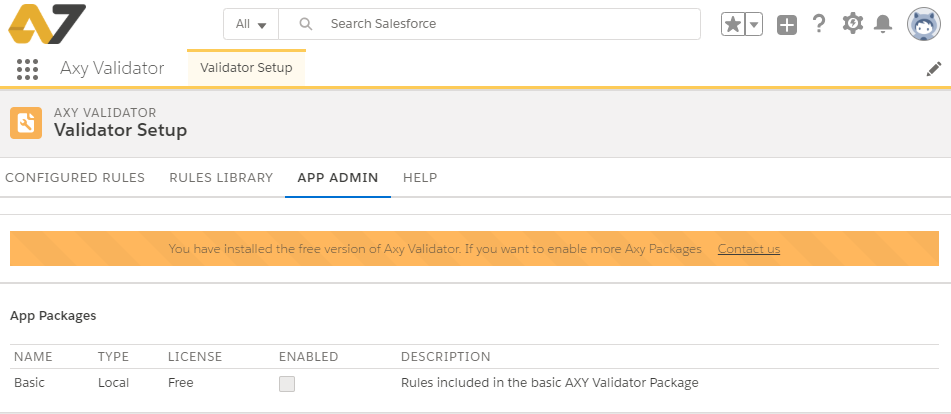

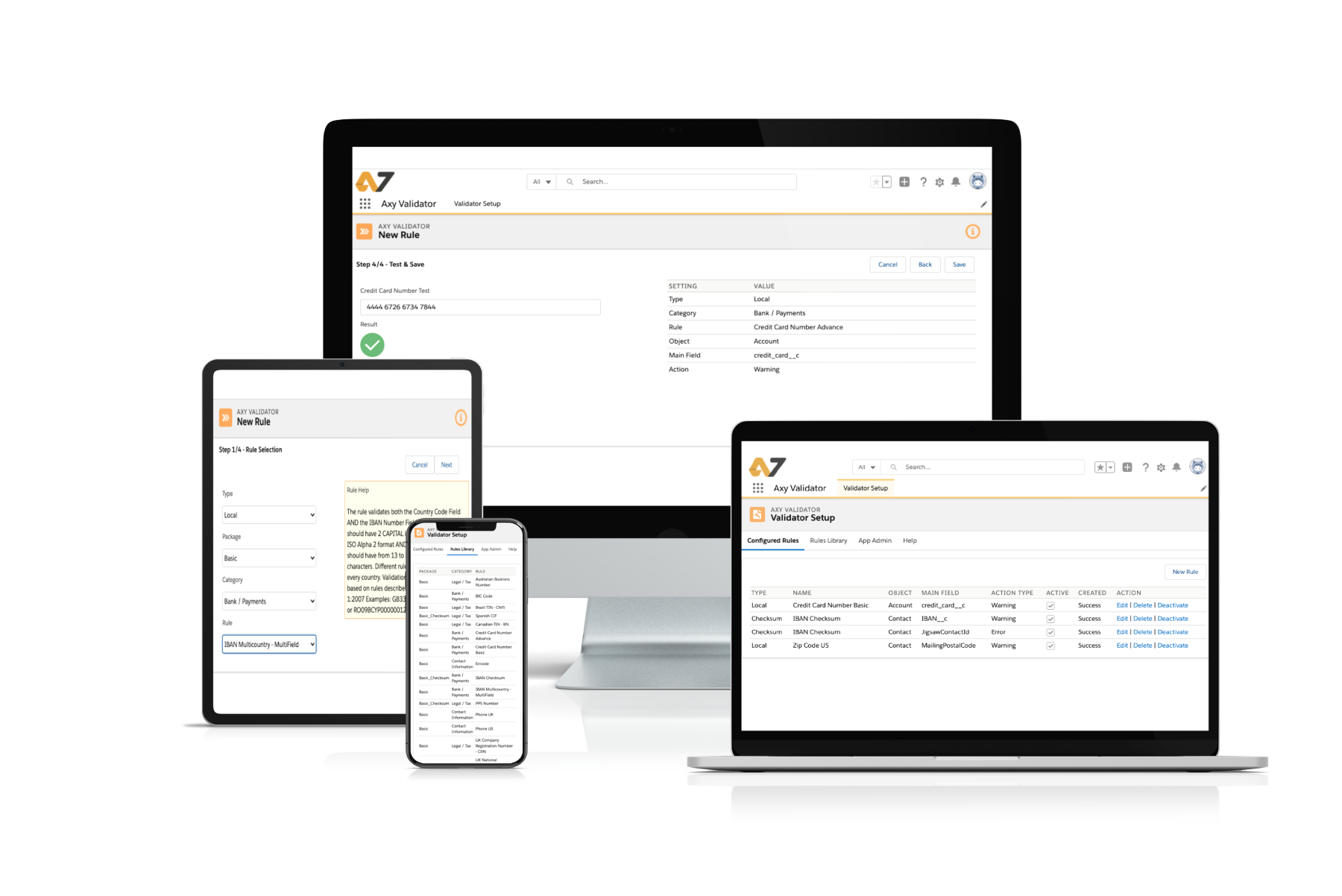

Is an Appexchange application that will provide you with common or complex validations to improve your Salesforce data quality and maximize your business performance. Axy Validator is easily installed and configured by your Salesforce Administrator, just with a few clicks.

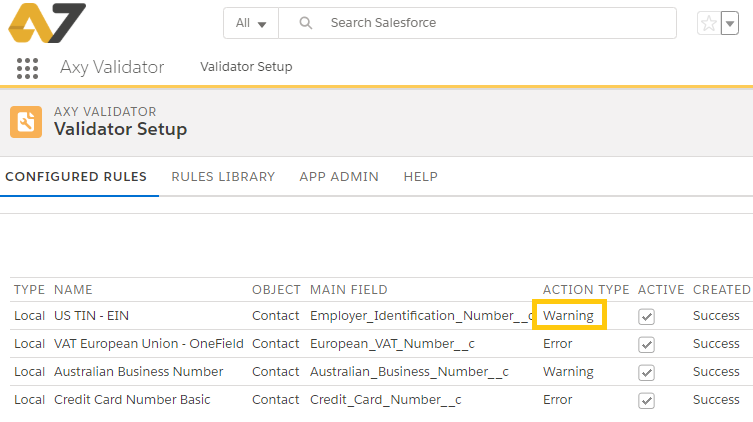

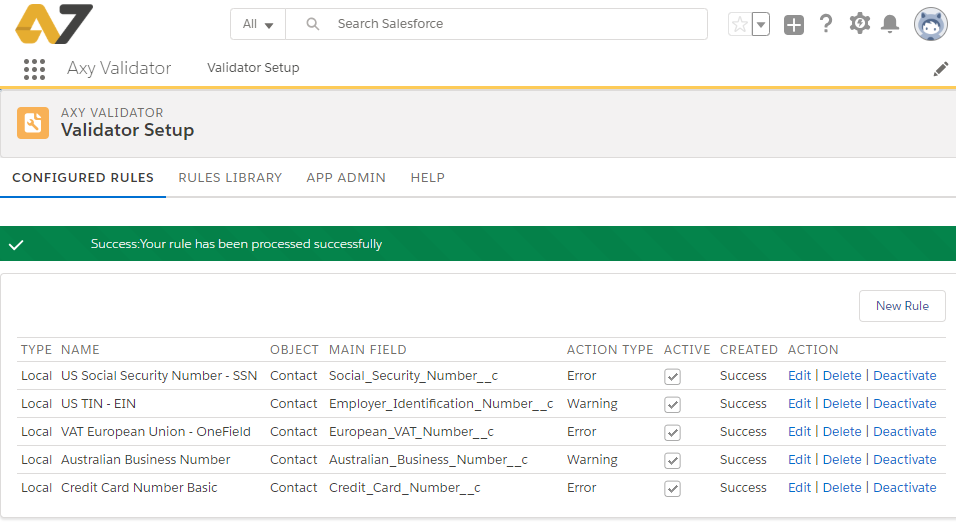

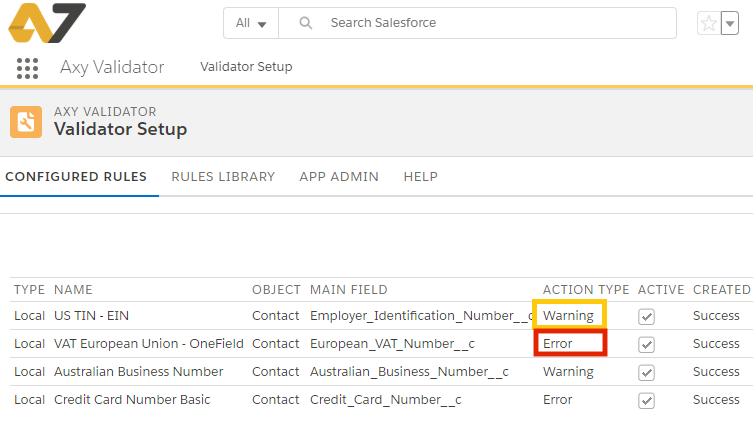

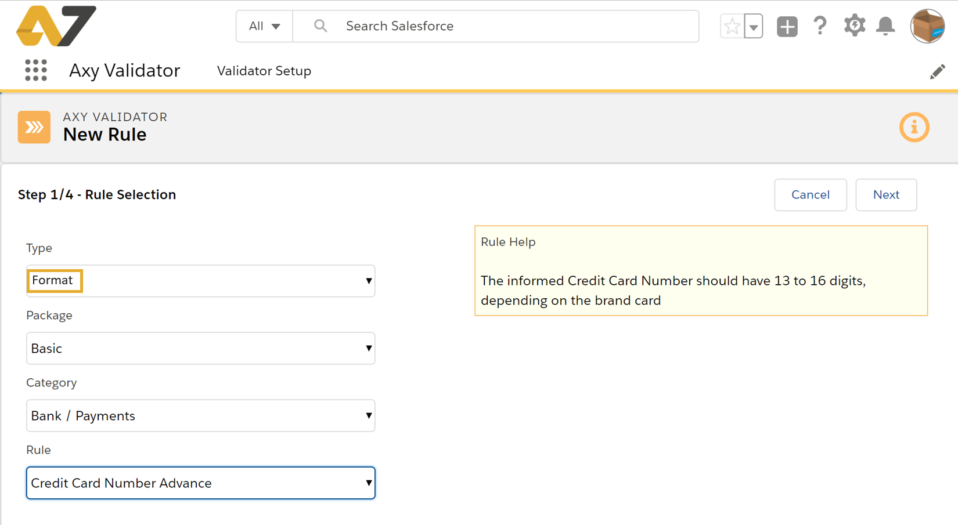

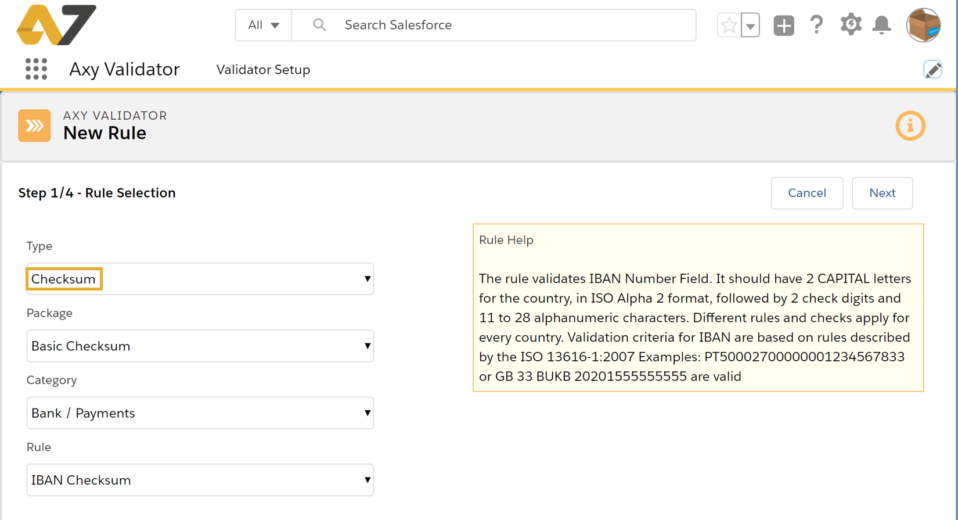

Axy Validator – Wizard Setup step by step

Validation Types

Our App provides three different validation types, depending on your business needs. Sometimes, the need to be very agile on data input only requires a format validation. There are other business situations where you need a more precise validation, so you need a checksum validation. Finally, you may need to assure you are using a valid and operative code.