Q: What is currency variance, and why is it important?

A: Currency variance represents the percentage change in the conversion rate of a currency over a specified period. For that, it’s a critical metric for businesses operating in multiple currencies, as it helps in understanding currency risks and making informed financial decisions.

Q: How do we calculate the variance for each currency in the Axy Currency Updater?

A: The variance is calculated based on the selected time frame (“Yesterday,” “30 Days,” or “365 Days”). For each currency, we compare the current conversion rate with the conversion rate at the start of the selected period.

The formula used is:

Variance Percentage=(Current Conversion Rate−Conversion Rate at Start of PeriodConversion Rate at Start of Period)×100Variance Percentage=(Conversion Rate at Start of PeriodCurrent Conversion Rate−Conversion Rate at Start of Period)×100

Q: How can I view the variance for a specific currency?

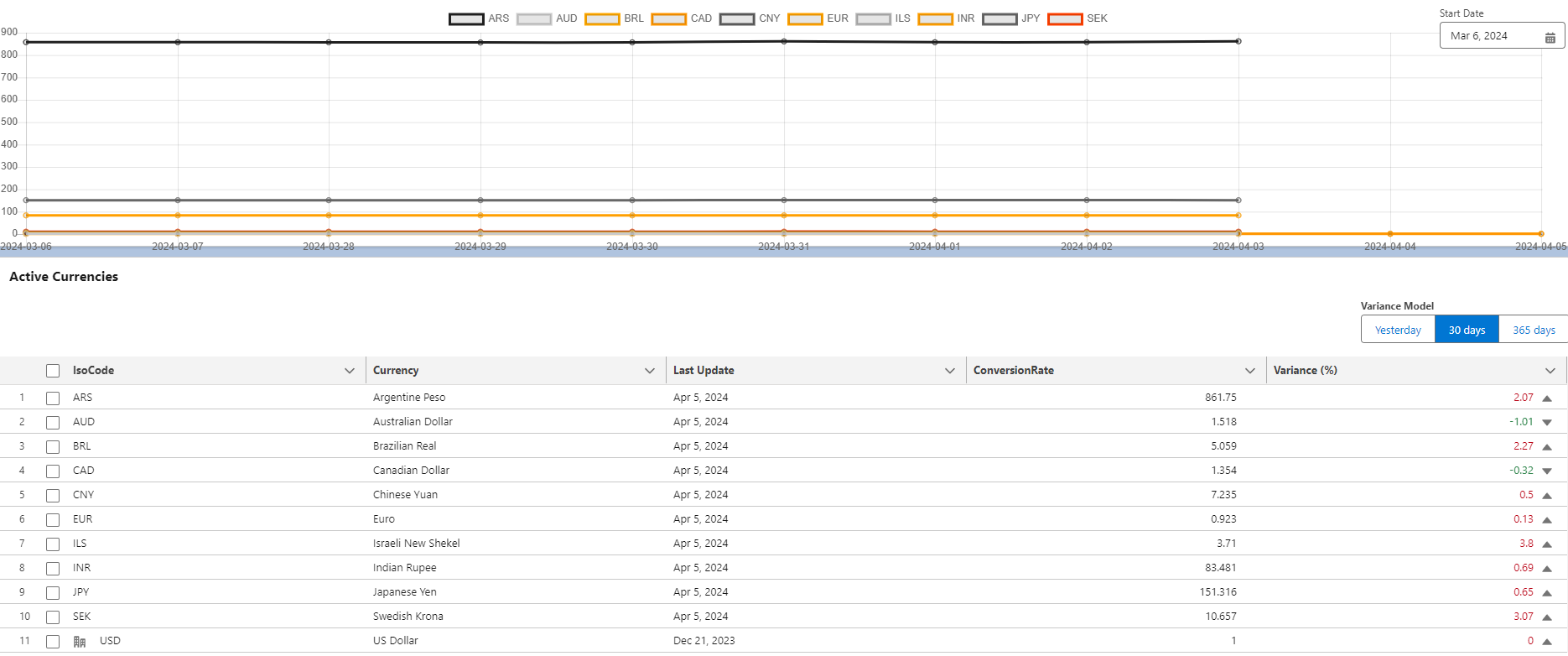

A: In the currency stats tab, use the “Variance Model” radio group to select your desired time frame. With this, the table will automatically update to display the variance percentages for each currency, allowing you to quickly assess their performance over the selected period.

Q: What does a positive or negative variance indicate?

A: A positive variance indicates an increase in the conversion rate of the currency over the selected period, suggesting a strengthening currency. However, a negative variance shows a decrease in the conversion rate, indicating a weakening currency.

We hope this feature enhances your currency management strategy and provides valuable insights into your financial operations.