How AI is transforming Salesforce financial processes: 2024 In-Depth analysis

The role of AI in Salesforce’s financial processes has grown immensely, with the 2024 Dreamforce announcements showcasing AI’s ability to streamline operations, enhance forecasting, and introduce automation to every aspect of financial management. With features like Einstein AI and Agentforce, businesses now have powerful tools to manage their financials with greater efficiency, predictive accuracy, and lower operational costs.

1. The Role of AI in Financial Processes

Salesforce has been using AI-driven financial tools to optimize operational workflows and strategic decision-making. With the introduction of Einstein Spend Analytics and Einstein Cash Flow Forecasting, finance teams are now better equipped to predict cash flow variations, detect financial anomalies, and optimize resource allocation. AI-powered systems also provide real-time insights, allowing companies to stay ahead of trends and better manage financial risks.

For instance, by leveraging Einstein Spend Analytics, companies can automatically flag unusual patterns in spending, such as discrepancies in vendor payments or unexpected spikes in operational costs. These real-time insights can prevent errors from escalating into significant financial problems.

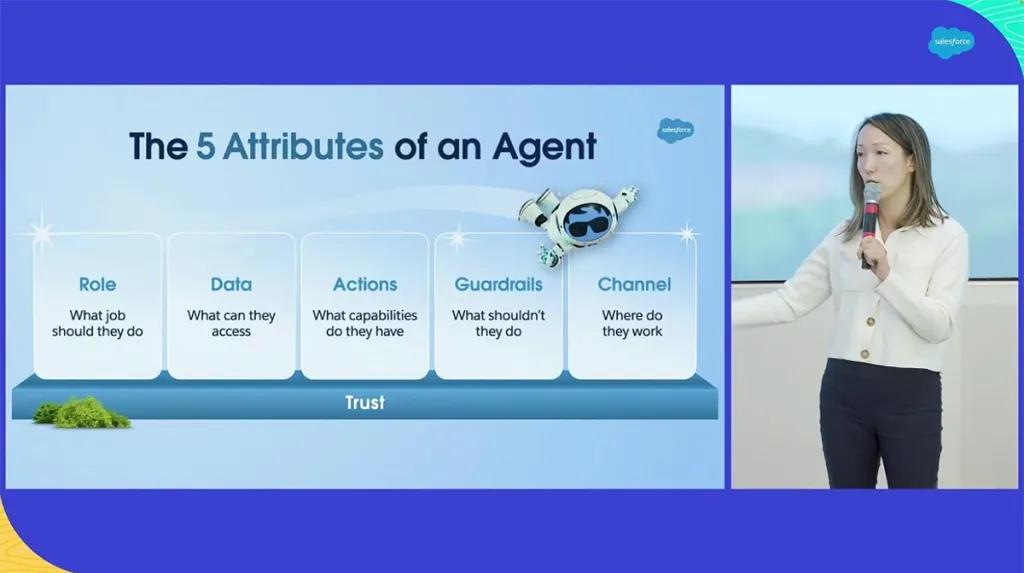

Additionally, Agentforce introduces autonomous AI agents that can handle routine tasks like processing invoices, managing expense reports, or even adjusting cash flow forecasts based on historical and real-time data. This can free up finance teams to focus on higher-level strategic activities.

2. AI-Driven Currency and Exchange Rate Management

Managing multi-currency transactions is one of the most complex aspects of financial management for global businesses. AI tools in Salesforce have taken the burden off finance teams by automating real-time exchange rate updates, providing insights into currency trends, and even predicting potential fluctuations.

Imagine a company dealing with international opportunities, using Salesforce’s Opportunity object. Typically, opportunities are managed in local currencies, which can fluctuate based on real-time market conditions. An AI tool like Einstein AI can automatically update exchange rates for each opportunity, ensuring that the forecasted revenue in the corporate currency reflects accurate financial expectations. AI can even predict optimal times for currency conversions, helping businesses minimize losses due to unfavorable currency movements.

For example, if a company’s Opportunity object includes an opportunity from Europe with a deal valued at €100,000, Einstein AI can dynamically adjust the value in USD based on the current exchange rate, providing the sales team with accurate insights into the financial impact of the deal in their home currency.

3. Dreamforce 2024 AI Announcements

At Dreamforce 2024, several new AI-driven tools were introduced to further improve financial and operational processes in Salesforce. Agentforce, a new AI agent platform, allows businesses to build autonomous agents capable of handling a range of financial tasks. These AI agents can be integrated directly into Salesforce objects like Opportunities, Accounts, and Invoices to execute routine tasks such as expense approval workflows, invoice matching, and payment scheduling.

Moreover, Einstein Copilot, another feature introduced at Dreamforce, acts as a personal AI assistant embedded in the Salesforce interface. This AI tool not only helps finance teams manage day-to-day tasks, but it also provides proactive recommendations, like suggesting next steps in payment collections or highlighting discrepancies in revenue forecasts based on current opportunities.

For instance, when handling an opportunity in the Opportunity object, Einstein Copilot could prompt the sales team with suggested actions, such as renegotiating payment terms or adjusting forecasts based on market fluctuations. This ability to make real-time suggestions based on the data Salesforce has collected over time helps companies stay ahead of potential financial pitfalls.

4. Best Practices for Salesforce Admins: Staying Up-to-Date

Salesforce administrators play a critical role in ensuring that their organizations fully benefit from AI capabilities. To maximize AI’s impact on financial processes, admins must focus on keeping Salesforce tools up to date. Dreamforce 2024 showcased the importance of Copilot Studio, a platform that allows admins to configure AI interactions across Salesforce. By building custom prompts and workflows, admins can ensure that AI is aligned with the company’s specific financial needs.

Admins should regularly review new updates from Salesforce, especially those tied to financial process enhancements. The Winter ’24 Release, for example, includes improvements in Salesforce Flow, a key tool for automating financial workflows such as approvals, budget allocations, and reporting.

Additionally, admins should explore third-party apps on AppExchange that integrate with AI tools for specialized financial needs, such as advanced currency management or tax automation. AppExchange offers a wealth of apps that can extend Salesforce’s native AI capabilities, particularly in areas like predictive analytics and international finance.

5. AI Use Case Examples in Salesforce Objects

Here are some examples of how Salesforce’s AI features can be applied directly to real Salesforce objects:

- Opportunities and AI Forecasting: A company using Salesforce’s Opportunity object can leverage AI to forecast the potential revenue from deals in different currencies. As an opportunity moves through the sales pipeline, Einstein AI can predict whether the deal will close on time based on historical data and external factors like market trends or currency fluctuations. AI can also automatically adjust forecasted revenue based on real-time exchange rates, ensuring that the finance team has accurate data for budgeting.

- Accounts and AI-Powered Credit Risk Analysis: When managing Accounts, AI tools can analyze financial data to assess the credit risk of a particular customer. By reviewing payment histories, outstanding invoices, and broader market conditions, AI can alert sales teams when a customer’s financial health deteriorates, prompting a conversation to renegotiate terms before a default occurs.

- Invoices and Automated Processing: AI can be embedded in Salesforce’s Invoice object to automate the processing of invoices. By integrating AI with Einstein Spend Analytics, invoices can be matched with purchase orders, discrepancies flagged, and approvals routed to the appropriate stakeholders. This reduces manual processing time and helps finance teams ensure accuracy and efficiency.

Conclusion

Salesforce’s integration of AI into financial processes is transforming how businesses operate, making them more efficient, predictive, and responsive to market changes. From automating currency management to improving cash flow forecasts, AI tools like Einstein AI, Agentforce, and Copilot are enabling businesses to optimize their financial operations. For Salesforce administrators, staying current with these innovations and continuously optimizing custom workflows will be key to maintaining a competitive edge in today’s fast-evolving financial landscape.

To learn more about Dreamforce 2024 and these innovations, check out the Dreamforce stream on Salesforce.