The Salesforce Revolution in the Financial Services Industry: Addressing Internal Challenges with AXY OKR

The financial services industry is renowned for its reliance on data-driven decision-making and customer-centric strategies. In recent years, Salesforce has emerged as the go-to CRM platform for companies within this sector, revolutionizing how they manage relationships, drive sales, and deliver exceptional customer experiences. However, like any industry, the financial services sector faces its own set of internal challenges. In this post, we will explore into the specific issues faced by the financial services industry when utilizing Salesforce and introduce how Axy OKR can help overcome these challenges and supercharge performance.

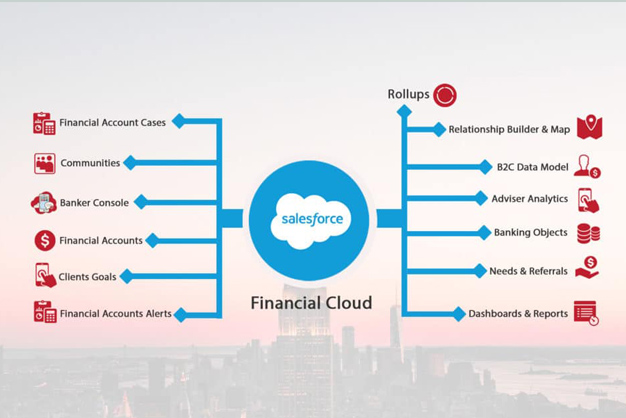

Salesforce Dominance in the Financial Services Industry:

The financial services industry has embraced Salesforce as a game-changing technology that empowers organizations to better understand their customers, automate processes, and drive business growth. With its extensive suite of features tailored to financial services, Salesforce has become the go-to CRM solution for banks, insurance companies, wealth management firms, and other financial institutions. Its robust capabilities, including customizable dashboards, integrations, and advanced analytics, have made it an indispensable tool for sales, marketing, and customer service teams in this sector.

Internal Challenges in the Financial Services Industry:

While Salesforce has transformed the way financial services companies operate, several internal challenges persist within the industry. Identifying and addressing these challenges is essential to ensure optimal utilization of Salesforce and maximize business outcomes. Here are a few common internal challenges faced by the financial services industry:

Compliance and Data Security:

Financial services institutions are subject to strict regulatory compliance requirements. Ensuring data security, maintaining compliance with industry standards, and protecting sensitive customer information is paramount. Failure to meet these requirements can lead to severe consequences, including legal and reputational damage.

Legacy System Integration:

Many financial services companies operate with legacy systems and multiple disparate data sources. Integrating these systems with Salesforce can be a complex and time-consuming process. Inadequate integration can result in data inconsistencies, duplication, and inefficiencies, hindering the overall effectiveness of Salesforce as a centralized CRM platform.

Workflow Optimization:

The financial services industry often deals with complex workflows and multi-step processes. Optimizing and automating these workflows within Salesforce is crucial to improving operational efficiency, reducing manual errors, and enhancing the overall customer experience. Without proper workflow optimization, organizations risk losing valuable time and resources on repetitive tasks.

Introducing Axy OKR for Salesforce:

Axy OKR is an innovative tool specifically designed to address the internal challenges faced by the financial services industry when using Salesforce. By integrating seamlessly with Salesforce, Axy OKR enhances the platform’s capabilities and helps financial services organizations overcome their internal hurdles.

Let’s consider an example within the wealth management sector:

Imagine a wealth management firm aiming to enhance its performance and drive growth. By implementing Axy OKR, the firm can establish clear objectives and key results (OKRs) to align its teams and achieve measurable outcomes. For instance, the firm sets an OKR to increase assets under management (AUM) by 15% in the next quarter. Key results include conducting targeted marketing campaigns, optimizing client onboarding processes, and enhancing the client referral program.

Axy OKR enables real-time tracking of progress toward these key results, providing transparency and accountability. Managers can monitor the metrics associated with each key result, such as the number of new client meetings scheduled, conversion rates, and client satisfaction scores. This data-driven approach empowers the firm to make informed decisions, identify areas for improvement, and ensure continuous growth.

Moreover, Axy OKR streamlines the integration of legacy systems, eliminating data inconsistencies and enabling a comprehensive view of customer information. It ensures compliance with regulatory requirements by implementing robust security measures, such as customizable access controls, data encryption, and audit trails. These features instill confidence in the firm’s ability to protect sensitive client data and maintain industry standards.

By leveraging Axy OKR for Salesforce, the wealth management firm achieves remarkable results. They surpass their AUM target, experiencing a 20% increase in assets under management. This success not only drives financial growth but also boosts employee morale and enhances the firm’s reputation in the market.

In conclusion, the financial services industry thrives on Salesforce, but internal challenges can hinder its full potential. Axy OKR addresses these challenges by providing seamless integration, ensuring compliance, and empowering organizations to set and track strategic objectives. With Axy OKR, financial services organizations can unleash their true capabilities and achieve remarkable success in a competitive market.

Contact us today and learn more about Axy OKR. In more than five years we created a comprehensive OKR solution designed to empower organizations in setting and achieving their objectives. With Axy OKR, you can streamline your OKR process, facilitate collaboration, and enhance performance tracking, all within the familiar Salesforce ecosystem.